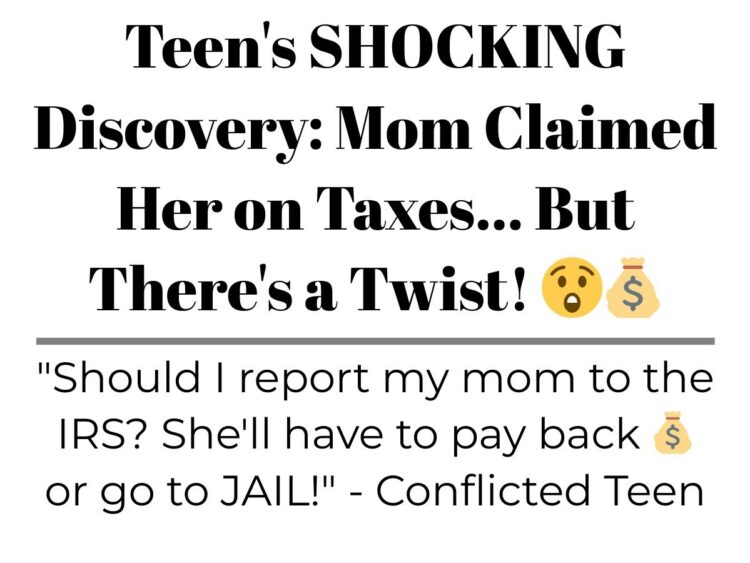

Buckle up, folks! We’ve got a juicy family drama brewing! Meet our 17-year-old protagonist, who’s been living with Grandma since 2019. She’s been working hard at her job since summer 2020, but recently discovered a shocking secret about her mom’s tax returns! Get ready for a wild ride filled with awkward conversations, tough decisions, and potential legal consequences!

Family Drama Alert!

Shocking Discovery!

Mom’s Big Plans

Awkward Conversation

Tax Time Troubles

⚖️ Consequences for Mom?

Update: Seeking Advice

♀️ The Outcome ♂️

Mom’s Shady Tax Moves: Will Our Hero Turn Her In?

Our young heroine is faced with a moral dilemma: should she report her jobless, legally blind mom to the IRS for claiming her on taxes? Mom’s got big plans for a house and car, but is it all built on a foundation of tax fraud? Counselors say it’s time to put her foot down, but the consequences could be dire. Will she risk ruining her mom’s chances at a fresh start? The internet weighs in with their thoughts on this sticky situation! ️ Let’s see what they have to say…

Protect yourself: Report her and secure your accounts!

![Image credit: [deleted] | [deleted]](https://static.diply.com/b69c3a4e-23f3-49af-90a8-cff1c46ee488.png)

Fraudulent mom claimed taxes, NTA for wanting to stop her

![Image credit: [deleted] | [deleted]](https://static.diply.com/bb36b57d-c49f-498d-acfa-305600b6b24a.png)

Protect yourself: report incorrect tax filings. NTA

Mom falsely claimed dependent for money Report her

![Image credit: [deleted] | [deleted]](https://static.diply.com/abea3b02-215c-4058-9a4f-9e1eca39d994.png)

One person’s opinion on reporting mom’s tax fraud.

Confusion over jobless mom’s ability to claim taxes

Don’t snitch on mom! IRS will catch it.

Coworker’s parents used her tax money to buy a dog ♀️. She works full-time and studies. Should she report them to IRS?

Mom illegally claiming taxes, NTA should claim themselves or grandma.

![Image credit: [deleted] | [deleted]](https://static.diply.com/aade8b45-5def-4f01-9235-35b87aed4825.png)

Don’t trust everything your counselor tells you . Filing taxes wrong? No jail time, just taxes+interest.

Lock your credit ASAP! Mom may be committing fraud

NTA. Exposing a fraudster parent and questioning their driving abilities

NTA, but advise seeking compensation for past property damage.

Claiming someone as a dependent they don’t support is tax fraud

Mom claimed me on taxes, got audited. Turn her in!

NTA. A helpful guide to reporting tax fraud with consequences.

Teen stands up to parents’ tax claim, wins.

Navigating taxes and family can be tricky

Confront mom, but don’t rat her out to the feds

Claimed as dependent by mom on taxes, teen advised to report

Protect yourself! Reporting your mom is the right thing.

NTA, but keep proof in case of audit.

Be careful filing taxes with mom, IRS will catch it!

Navigating family taxes can be tricky, reporting might not help

Grandma had the right to claim, not mom. NTA

Helpful explanation of tax residency requirements and potential consequences.

Custody agreement may explain mom’s tax claim. Accessory to fraud?

When someone falsely claims your child on taxes

File taxes correctly and nope out at 18!

![Image credit: [deleted] | [deleted]](https://static.diply.com/2515c4d1-635f-430b-876b-bb684e38e2f7.png)

Protect yourself financially and don’t feel guilty about it!

Being claimed as a dependent can mess up your financial aid. NTA

Misunderstanding of tax laws explained by commenter

Protect yourself from tax fraud and identity theft!

Who pays for expenses? Can she claim as dependent?

No legal recourse but can prevent future tax refunds.

Is it worth it? NTA but think it through.

Take control back! NTA. Report your parents.

Understanding the legalities and complexities of dependent claims.

Report mom’s fraud or risk getting in trouble too. NTA

Tax fraud alert! OP is NTA for standing up for themselves.

Grandma has the power to make it official

Struggling with taxes? Share your story with us!

![Image credit: [deleted] | [deleted]](https://static.diply.com/264dd6d6-b51b-49a8-a8b2-a550886a3069.png)

Think twice before taking action and consider the consequences. ⚖️

Mom fraudulently claimed me on taxes, what should I do?

Reporting mom for tax fraud: NTA but assault is wrong

![Image credit: [deleted] | [deleted]](https://static.diply.com/7d0a7a3d-7b94-4b6d-9f19-43f59c1dbb39.png)

Calling out tax fraud with a patriotic twist

Report fraud to the IRS, save mom from bigger trouble later

Confused UK citizen reacts to complicated US tax system

File taxes, freeze credit to prevent fraud. NTA, obviously.

![Image credit: [deleted] | [deleted]](https://static.diply.com/3735869d-42b6-4217-8578-79e56bc9a92a.png)

Taking credit for taxes and money that’s yours? NTA.

Turn the tables on mom with IRS reporting!

Avoiding fraud, filing separately, and no conflict in judgement

![Image credit: [deleted] | [deleted]](https://static.diply.com/04a07667-6402-407b-b89b-57fc42e3b75f.png)

Report her! NTA asks about stimulus checks and suggests granny claim.

OP’s concern for legal consequences and family relationships.

NTA says report mom for fraud and bad vision to DMV.

Report fraud to IRS, your grandma should claim you instead

Report mom to IRS for fraudulently declaring you. NTA.

Ex-partner shares similar experience; encourages reporting.

![Image credit: [deleted] | [deleted]](https://static.diply.com/60a930d4-90ef-447f-a593-0ed033dee50a.png)

Is it worth reporting your mom for tax fraud? YTA if not harming anyone and just causing problems.

![Image credit: [deleted] | [deleted]](https://static.diply.com/58630f10-8bbb-48b2-a69c-dde40131f5b6.png)

Don’t mess with the IRS! ♂️ NTA calls out fraud.

Report her, not your responsibility.

Reporting mom’s tax fraud: risky move or justified action?

Can you really tell if someone claimed you on taxes?

Minor files taxes, wonders if mom took stimulus money

NTA uncovers IRS twist, commenter rages against ‘a**holes’

Stand up for yourself! Report mom to IRS for fraud

Teen plans to give her mom two tax returns

Parent’s tax fraud ruined child’s college loans. Report the crime!

Claim yourself on taxes, let IRS handle it

Grandma should claim you, report mom for fraudulent refund

Expert tax advice needed, Reddit can’t help this time.

Sarcastic advice on paying taxes, NTA comment section