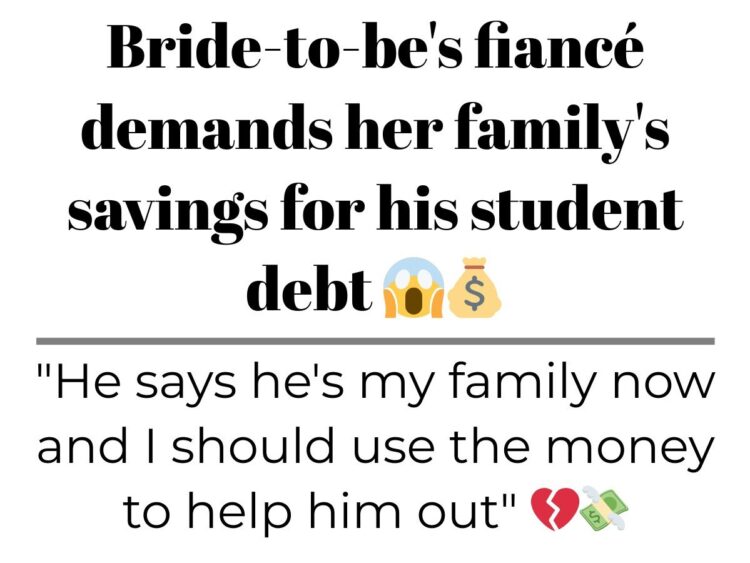

Imagine being excited about your upcoming wedding, only to have your fiancé demand that you use your family’s savings to pay off his student loans. That’s the situation one bride-to-be found herself in when her fiancé discovered the amount of money she had in her savings account. Raised with the belief that her family’s finances were intertwined, she’s now torn between her fiancé’s demands and her family’s expectations. Let’s dive into this emotional rollercoaster of a story.

The Cultural Background

Fiancé’s Upbringing

The Big Reveal

Explaining the Situation ️

The Family Savings

Fiancé’s Argument

The Blow Up

Standing Her Ground

Reevaluating the Relationship

The Change in Him

Parents’ Retirement Plan

Living Arrangements

Rethinking the Relationship

Clarifying the Money Situation

Family Support

The Future of Their Relationship

Caught between her fiancé’s demands and her family’s expectations, our bride-to-be is left questioning the future of her relationship. She’s willing to help with his debt, but only if her parents agree, and not by giving away all of their savings. Her fiancé’s sudden change in attitude after their engagement has left her confused and hurt. Will they be able to find a compromise, or is this the end of their love story? Let’s see what the internet thinks of this situation…

Money matters can make or break a marriage.

Discuss finances before marriage to avoid future conflicts. NTA.

Premarital counseling and communication are key to resolving financial conflicts

Couple not ready for marriage, need financial agreement before wedding

Discussion on finances and prenuptial agreements for engaged couple

Red flag alert! NTA, boyfriend needs to back off.

Keep finances separate if he can’t respect your family’s savings

![Image credit: [deleted] | [deleted]](https://static.diply.com/fffe563f-03f9-4c03-8873-142e3e71e84b.png)

Fiancé demands family savings for debt, commenter says NTA

Protect your family’s savings with a prenup and separate accounts

Protect your assets with a prenup

Navigating finances in a relationship can be tough, but communication is key

Personal debt is personal responsibility, not the partner’s. NTA.

Fiancé demands bride’s family savings for his debt. Commenter advises saving.

NTA wants premarital counseling due to major financial values rift

![Image credit: [deleted] | [deleted]](https://static.diply.com/c0428ea9-3cc6-4e59-9431-092c7102088d.png)

Your money, your family’s savings. Have a serious talk

Protect your assets: NTA comment warns of divorce implications.

![Image credit: [deleted] | [deleted]](https://static.diply.com/f2e3f9b0-4757-4b87-b445-6c9216a5bec0.png)

Cultural differences and familial piety cause financial disagreement. Counseling recommended.

Cultural and financial attitudes clash in this tricky situation

NTA. Fiancé wants family savings for student debt ♀️

Fiancé demands bride-to-be’s savings for his debt . Commenter says NTA and explains why.

Cultural entitlement or dowry? Red flag for bride-to-be

Dump the freeloading fiancé who demands your family’s savings

Don’t be scammed! He’s living rent-free and wants your savings? NTA

Couple needs to prioritize and decide if marriage is right

Set clear boundaries with your fiancé, it’s your hard-earned money

NTA for not giving savings to fiancé, but may change later.

Interracial couple shares heartwarming story of caring for in-laws ❤️

NTA commenter questions society’s obsession with others’ finances.

Supportive comment from American, advises to consider leaving fiancé.

Get a prenup and work with a financial advisor

![Image credit: [deleted] | [deleted]](https://static.diply.com/5da31025-8a13-432b-8409-71932217c331.png)

NTA, your fiance is a freeloader and doesn’t respect you

Don’t let your fiancé guilt you into paying his debts

Fiancé wants bride-to-be’s family savings for debt, commenters disagree.

Redditors debate whether fiancé’s request is a dealbreaker

Respectful comment defends bride-to-be’s family savings in cultural context.

Fiancé demands bride’s family savings for his debt ♀️, commenter says NTA and suggests communication

Navigating cultural differences in finances for a harmonious marriage

NTA for refusing to pay fiancé’s student debt.

Don’t let him guilt trip you! NTA

![Image credit: [deleted] | [deleted]](https://static.diply.com/45e15b0d-5a44-41d3-8a13-29c6547eae7f.png)

Double standards in judgement based on gender. NTA, entitled fiance.

Fiancé wants her family’s savings for his debt but commenters agree she’s NTA and he’s selfish.

Protect your assets with a prenup! Don’t let him dig.

Red flags in the relationship Call off the wedding

Fiancé demands bride’s family savings for his debt . Commenter calls him greedy and selfish.

Don’t let him guilt you into paying his student debt

Fiancé demands family’s savings for debt? NTA, he’s selfish

Fiancé demands her family’s savings for his student debt . Commenter advises OP to prioritize her family over him.

Fiancé demands bride’s family savings for student debt. NTA responds.

Partner demands family savings for debt, commenter says NTA.

NTA – Discuss finances maturely before the wedding to avoid conflict

Refusing to pay fiancé’s student debt: NTA, red flag

Break up with him and move on to better things.

![Image credit: [deleted] | [deleted]](https://static.diply.com/b5a3589c-809c-4309-951d-30d17adf6e39.png)

Maintaining separate finances is important for a healthy marriage

Fiancé demands her family’s savings for his debt. YWNBTA.

Fiancé demands her family’s savings for his student debt . Commenter says NTA, he should live with his own debt.

Fiancé demands bride’s family savings for his debt NTA stands up for herself and her family

Fiancé demands savings, comment suggests he tackle his own debt

Don’t marry a man who demands your family’s savings

Accepting your partner’s family is important. NTA

Fiancé demands bride-to-be’s family savings for his debt

NTA suggests a frank discussion about finances and living arrangements

Don’t let him touch your savings! He’s being greedy

Fiancé wants her family’s savings for his student debt? NTA. Break up.

Fiancé demands bride-to-be’s family savings for student debt NTA suggests paying off loans after marriage with conditions.

Engage a financial advisor to protect your savings from fiancé

Plan ahead for financial harmony in marriage

Entitled fiancé demands bride-to-be’s family savings for his debt

Red flag alert: NTA commenter advises prenup for fiancé’s debt.

Bride-to-be stands her ground against fiancé’s unreasonable demand

Pre-marital counseling suggested for fiance demanding family savings for debt

Fiancé sees you as a payday for his debt? NTA

Don’t let him guilt-trip you, NTA. It’s YOUR debt.

Fiancé demands her family’s savings for his student debt? NTA!