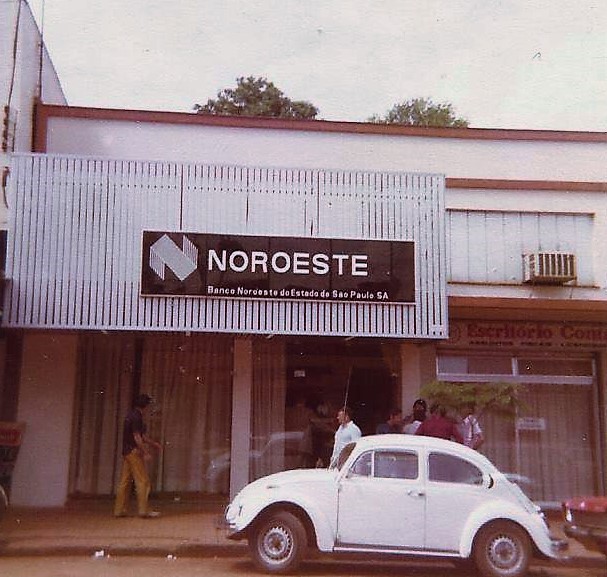

In a shocking fraud scheme, former Union Bank of Nigeria director Emmanuel Nwude tricked a Brazilian bank into investing in a nonexistent airport. Through skillful deception, he pocketed $242 million, ultimately causing Banco Noroeste to collapse. This elaborate scam went unnoticed until a takeover by Santander revealed the shocking truth behind the missing funds.

Claiming an identity was the first step in the plan

Nwude set the stage by posing as Paul Ogwuma, the Central Bank of Nigeria’s governor. Under this guise, he convinced Banco Noroeste director Nelson Sakaguchi that the “airport project” was a sound investment opportunity. Leveraging his insider knowledge, Nwude crafted a believable scenario.

Sakaguchi saw this as a potentially profitable deal

Sakaguchi, eager for a profitable opportunity, believed Nwude’s claim that he’d gain a $10 million commission if the airport plan succeeded. Blinded by the potential earnings, Sakaguchi approved payments without thorough verification, sealing the bank’s unfortunate fate.

Between 1995 and 1998, money flowed without questions

Embed from Getty Images

Between 1995 and 1998, Banco Noroeste paid Nwude a staggering $242 million, convinced of the airport’s legitimacy. Despite the unusual circumstances, the bank never questioned the project’s existence or required tangible proof, trusting Nwude’s authority as an industry insider.

The scheme unraveled when Banco Noroeste’s financials were audited

The fraud came to light in 1997, as Santander prepared to acquire Banco Noroeste. During due diligence, the company discovered irregularities in Noroeste’s financials, which included unexplained funds in offshore accounts and payments for the nonexistent airport.

Santander’s takeover couldn’t save Banco Noroeste from ruin

Embed from Getty Images

Despite Santander’s acquisition, the enormous financial loss proved too devastating for Banco Noroeste to survive. In 2001, Banco Noroeste ceased operations, its collapse marking one of the largest fraud-driven bank failures in history.

A swift legal response was launched to seek justice

Embed from Getty Images

After realizing the extent of the deception, authorities launched a criminal investigation. The aim was to understand how Nwude successfully swindled millions from a major bank, a scandal that rocked financial sectors worldwide and prompted international scrutiny.

Court proceedings faced hurdles, delays, and a twist of events

Embed from Getty Images

Nwude and his accomplices were eventually brought to trial in 2004, but the case took an unexpected turn and was dismissed. Authorities re-arrested them, and they faced new charges in a second trial, shedding light on the elaborate scam in its entirety.

A guilty plea with over 100 counts of fraud confirmed the scheme

Embed from Getty Images

Nwude and his team pleaded guilty to over 100 charges of fraud and bribery, bringing a semblance of closure to the case. Despite the elaborate nature of the scheme, the team admitted their roles in the massive bank heist.

A last-minute bribery attempt only complicated things further

Embed from Getty Images

In a desperate bid to escape punishment, Nwude attempted to bribe officials with $75,000 after one accomplice confessed. This attempt backfired, adding to the list of charges and further diminishing his chances for leniency in sentencing.

Ultimately, Nwude received 25 years but got out early

Sentenced to 25 years, Nwude faced substantial prison time for orchestrating the fraud. However, he was granted an early release in 2006, marking the end of one of the world’s most infamous bank fraud cases.