For many Americans, the cost of receiving healthcare serves is a proverbial elephant in the room. As if suffering a debilitating injury or contracting a serious illness wasn’t a sufficiently scary situation on its own, the question of how they’ll pay for treatment is often an even bigger stressor.

Unfortunately, this can often lead some desperate patients to try and catch an Uber to the hospital to avoid hundreds of dollars in charges for an ambulance ride.

And as the responses to one simple question on Twitter make abundantly clear, that’s only scratching the surface of how devastating medical bills can be.

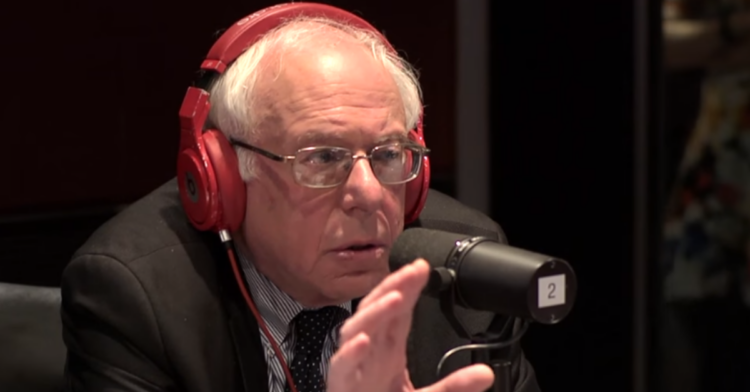

Over the weekend, Vermont Senator and Presidential Candidate Bernie Sanders took to Twitter to ask users about their “most absurd” medical bills.

The tweet has since received over 12,000 responses and the more of them you read, the more grim they start to sound.

As one response makes clear, it doesn’t take much for a simple medical issue to turn into a serious financial burden.

Even after some help from their insurance company, this person was still left with an almost $50,000 hole in their pocket after an unavoidable broken ankle.

Sadly, it didn’t take long for these responses to go from stress-inducing to tragic.

In Dr. Jen Gunter’s case, she received a $600 dollar charge for literally no medical care on her son who had died almost immediately after birth.

She also said she was charged twice for an X-ray that one of her other children underwent and this was only cleared up after some intense arguments with a collections department.

In these most tragic of cases, parents can effectively lose their children to a dystopian nightmare.

Although this person theoretically should have received treatment before payment was even discussed, the reality is that some absent proof of insurance turned a $1,500 medical bill into a $350,000 one.

Worse yet, it apparently turned a person’s life into a solemn memory.

As some of these responses make clear, a procedure that’s seemingly covered and suddenly fall on the patient due to networking issues.

Unfortunately, it doesn’t even seem to matter whether a hospital is within the insurance provider’s network as long as the surgeon involved in the procedure isn’t.

Worse yet, this isn’t something the patient has any control over.

When a healthcare system allows for massive costs to fall on the patient, someone else’s dangerous actions can go from a close call to potentially life-ruining all over again.

When a drunk driver that this man said had no insurance hit a limo he happened to be riding in, they forced him into the hospital.

From there, this driver indirectly forced him into a situation where he had to seek legal advice to decrease a $45,000 medical bill.

Although this may depend on where his story takes place, the billing practice one user ran into may very well have been illegal.

Emergency Room staff are required to treat emergencies that threaten patients’ lives regardless of a patient’s ability to pay for it, but one billing representative was apparently counting on this man not to know that.

In this case, an urgent care facility would likely have served the patient’s needs with the exorbitant price tag.

But even if we take that into account, having to pay $12,000 dollars for a treatment they could have received for a fraction of the cost elsewhere seems completely insane.

As one man’s story makes clear, Americans have had to face overwhelming costs for treatment for a long time.

Imagine finally recovering from a debilitating injury that put you in the hospital for months only to realize that you know owe more money than you can even picture getting your hands on.

And that’s not even taking into account the fight to reduce that to “only” a quarter of a million dollars.

Unfortunately, that sudden cost for out-of-network services can reveal itself in unexpected ways.

After all, even if both the hospital and the surgeon are within the insurance provider’s network, a heavy cost can still be forthcoming if the anesthesiologist isn’t.

Even though there are cases that can legitimately covered by insurance, this could have very easily happened to someone without it.

Another user pointed out that this is the type of case that makes it hard to understand why allergy testing isn’t covered by health insurance.

After all, those companies wouldn’t have to settle as many allergy claims if the tests were more affordable.

A medical bill shouldn’t have to be on anyone’s mind when they’ve just lost a child, but keeping it there is what a collection agency does.

When this person found themselves facing harassment from one of these agencies over a $10,000 bill for their fallen child’s neonatal care, it took them two months to get them to stop.

It turned out that there’s a 30 day period before a child has to be added to an insurance policy, so this never should have taken place at all.

Depending on what this MS patient was treated with, it’s possible for this cost to skyrocket even higher than it may seem.

That $80,000 price tag seems bad enough on its own, but some MS treatments can go on for about five days in a row according to the Mayo Clinic .

With this in mind, it wouldn’t be impossible for treatment costs to approach $400,000.

Although it’s better to prevent a disease you’re at risk of than wait to try and cure it, that has its own financial difficulties.

For this user, the only thing that rivaled the great expense itself was the expectation that the patient could somehow get that money together in two weeks.

When the insurance company and the doctor disagree, the patient gets caught in the middle.

![Image credit: Reddit | [deleted]](https://static.diply.com/UgswofjtKRPHoGpZx7OQ.jpg)

One man found himself owing $15,000 when his son was born, despite the fact that this birth was supposed to be covered.

Despite the doctor informing the family that a C-section may be necessary for the child’s survival, the insurance company refused to cover it because they considered it an elective. Apparently, that qualifier that the child “may” die was enough for them to decline coverage.

This man may have been OK by the time he was checked out, but he wasn’t when he received his bill.

Although the EMTs managed to take care of his heat exhaustion on their own, he ended up on the hook for $12,000 after he underwent three hours of tests to confirm this.

Apparently, this person’s insurance company thought they had a better sense of what was medically necessary than their neurologist.

Apparently, the decade of schooling that doctor went through to get to that position couldn’t outweigh the company’s willingness to pass a $100,000 medical bill on to their supposed customer.

It would be interesting to hear how the insurance company thought a completely paralyzed patient was otherwise supposed to make it to the hospital from a mountain highway.

Fortunately, this person was able to get this decision reversed, but it definitely seemed like a blatant attempt to try and offload a $50,000 bill on their customer.

This dad was apparently supposed to know that his local hospital doesn’t treat children.

And so, when they had his daughter airlifted to another hospital, his family ended up stuck with the $27,000 bill with no help from the insurance company.

Although the price tag for this patient wasn’t as nightmarishly high as some others we’ve seen, it likely still made for the most expensive minute of her life.

From the sound of it, she could’ve FaceTimed a doctor and received the same information for much less money spent.