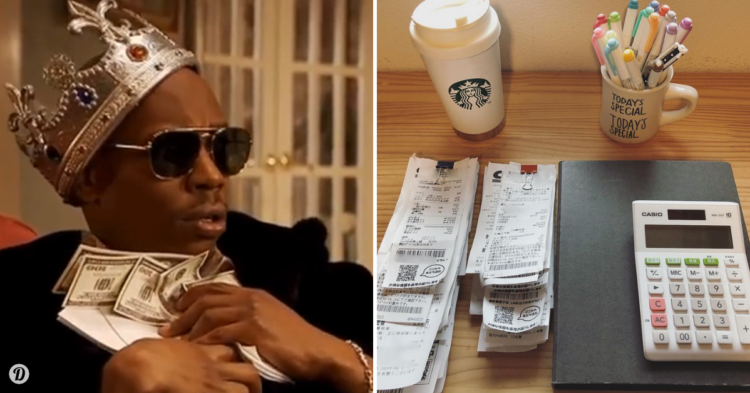

Let’s face it, budgeting isn’t easy. It isn’t much fun, either. Nothing brings you back to a soul-crushing reality like going over your receipts and bills and then comparing them to your paychecks.

We didn’t learn about this stuff in school, either. At least, I didn’t. So it doesn’t exactly come second-nature to me or many others. But that doesn’t make it any less important.

Getting your finances under control isn’t just good for your bank account — it’s great for your spirits, too. Money troubles cause huge stresses in life. It doesn’t have to be that way, though.

Budgeting, believe it or not, is becoming trendy, thanks in large part to a Japanese money saving technique called Kakeibo.

The 115-year-old practice is basically a method of organizing your spending every month — before your whole paycheck is gone. The word “kakeibo” translates to “household account book,” but there’s more to it than just writing things down in a ledger.

Which isn’t to say that writing down your income and your expenditures isn’t a good idea.

With kakeibo , it takes a bit of a turn. As normal, you start out by writing down your fixed expenses, things like your mortgage/rent payments, internet bill, anything that doesn’t change from month to month, and compare it to your income. Whatever is leftover is what you have to play with for the rest of the month.

Next, set yourself a goal of how much you want to save in the coming month and set that money aside.

Assume that money no longer exists. It’s untouchable. Then, split your further spending throughout the month into four columns:

Survival — things like food, children, transportation, and heating

Optional — coffees, shopping, eating out

Culture — TV, movies, books

Extra — gifts, repairs, major purchases you’d only make once in a while, like appliances

You also need to establish two things for the month: A goal, like saving for a trip or a new car, and a promise, like quitting sugar.

At the end of the month, there’s a battle between the “savings pig” and the “expenses wolf.” If there’s anything left over, well, congratulations on saving money.

There are a few important things kakeibo does for your budget.

First, it makes you more mindful of where all your money is going every month. Second, it gets you thinking about delayed gratification and accomplishing more long-term things, like saving up for vacations instead of putting them on credit and chasing that bill for months later.

Supporters of kakeibo say it’s possible to save up to 35% every month, which I think we would all welcome in our lives.

And you don’t even have to call it kakeibo if you don’t want to — just thinking about how you spend your money and writing it down on paper is a good start.

h/t: Moni Ninja